Industry Report Q1 2025

Executive Summary

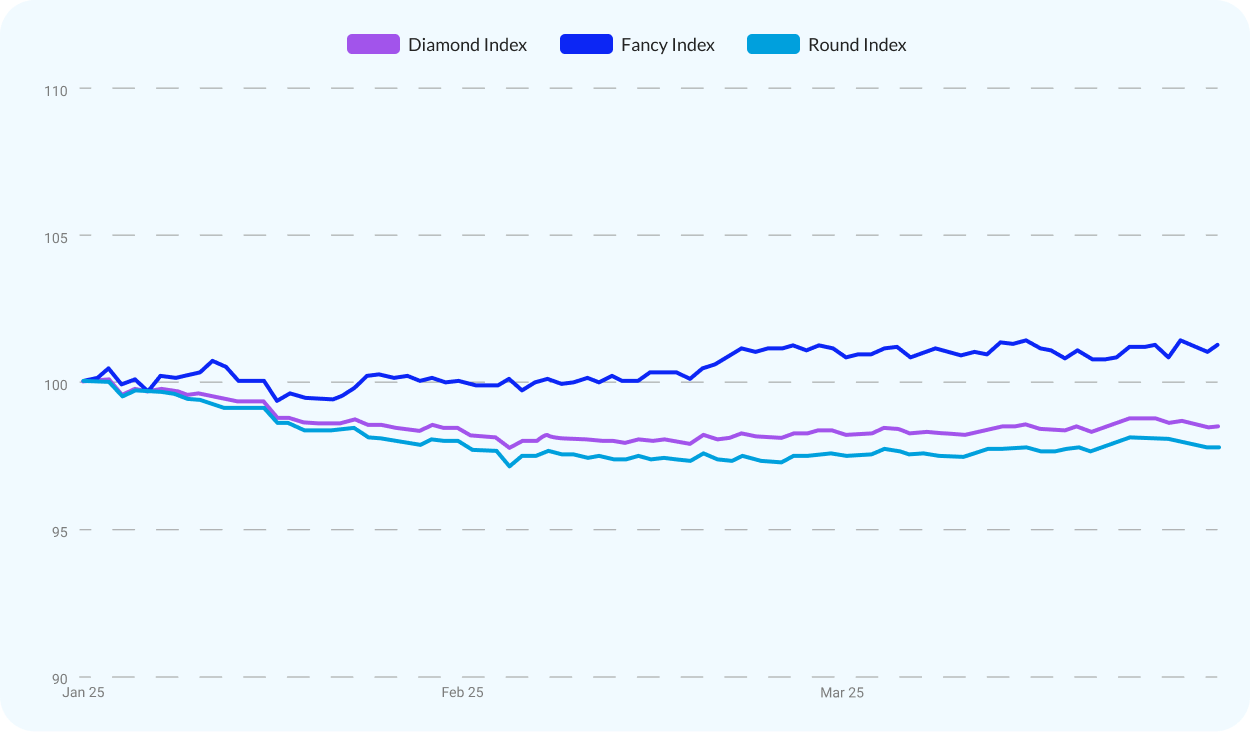

This report, powered by UNI Diamonds' real-time data and analytics, provides a detailed analysis of the diamond market in Q1 2025, focusing on price trends, supply dynamics, and key size groups. Following the price list reductions in early January, the quarter began with price declines across most categories, but conditions stabilized in February and March, leading to a more balanced quarter overall. The Diamond Index dropped by just 1.5%, reflecting the market’s continued move toward stabilization after a year of corrections.

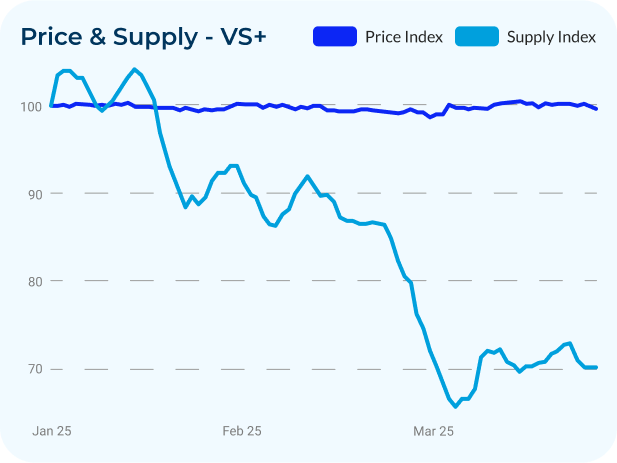

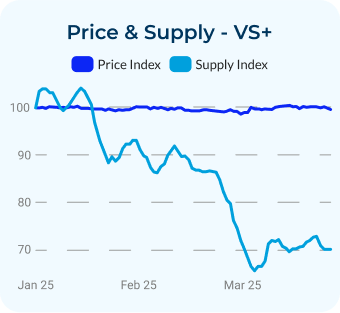

VS+ stones in most key size groups benefited from consistent supply reductions, which helped limit price drops and, in some cases, supported price increases, particularly in 0.30cts, 0.50cts, and the larger sizes. Meanwhile, SI stones continued to face ongoing price declines, especially in the smaller size groups, though signs of stabilization began to emerge as the quarter progressed.

Notably, 0.30ct, 0.50ct, 2ct, and 3ct stones showed the strongest signs of balance, with stable prices and falling supply suggesting improving conditions for these segments. This trend points to growing stability in the larger size groups. As supply continues to tighten, these categories may offer stronger opportunities for traders in the months ahead.

In parallel, newly imposed U.S. tariffs on diamond imports have introduced fresh uncertainty to the industry. The full impact of these tariffs remains to be seen, but they are expected to influence pricing, demand, and sourcing in the coming months.

Overview of the Industry

Diamond Index

The Diamond Index showed signs of well-anticipated stabilization throughout Q1 2025. After a slight decline during January, fueled by reductions in the January price lists across the market, the index gradually recovered through February and March, leading to a more stable quarter for the diamond market. In total, the Diamond Index fell by just 1.5%, continuing the trend of slowing price declines seen at the end of 2024. This suggests a market that is levelling out, providing a potentially more predictable environment for both buyers and sellers.

Round Index

The Round Index recorded a 2.3% drop over Q1 2025. Most of this decline occurred in January, with prices stabilizing across February and March. While the segment remains under pressure, the halt in declines later in the quarter suggests some underlying support, possibly tied to more stable inventory levels and shifting buyer preferences.

Fancy Index

Fancy shapes performed notably well during Q1 2025. The Fancy Index rose by 1.25%, continuing the upward trajectory observed in the previous quarter. This price growth was driven by ongoing demand and very low levels of inventory—particularly in popular shapes like ovals—underscoring the increasing importance of fancy-shaped stones in overall market dynamics.

Round 0.30ct Stones

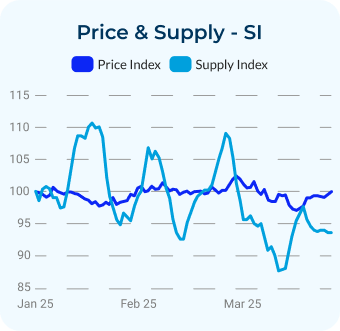

0.30ct Round stones showed contrasting dynamics between clarity categories in Q1 2025. VS+ stones remained stable throughout the quarter, with a minor dip in mid-January followed by a recovery in March. From start to finish, prices ended at the same level as in early January. Notably, VVS+ collection color goods posted the strongest gains, while VS+ I+ goods all recorded modest price increases. Supply for this category dropped sharply over Q1, declining by 58%, contributing to price firmness across higher-clarity goods.

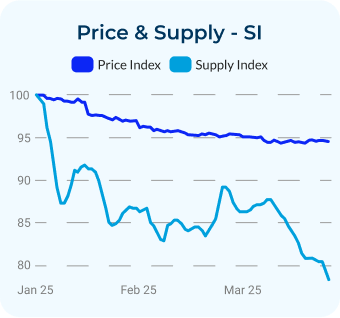

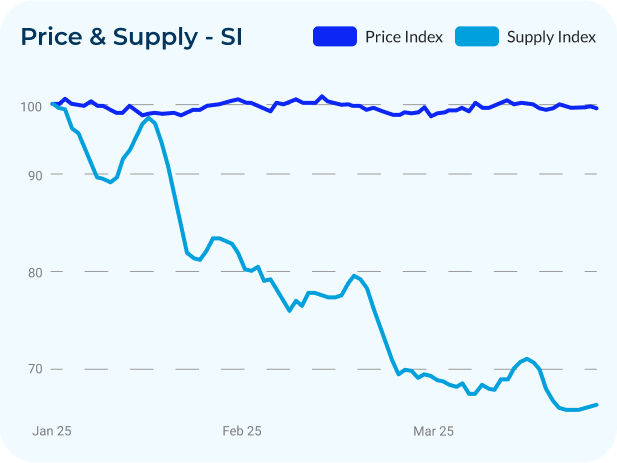

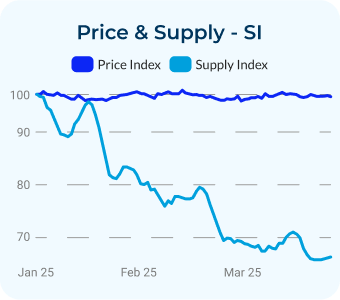

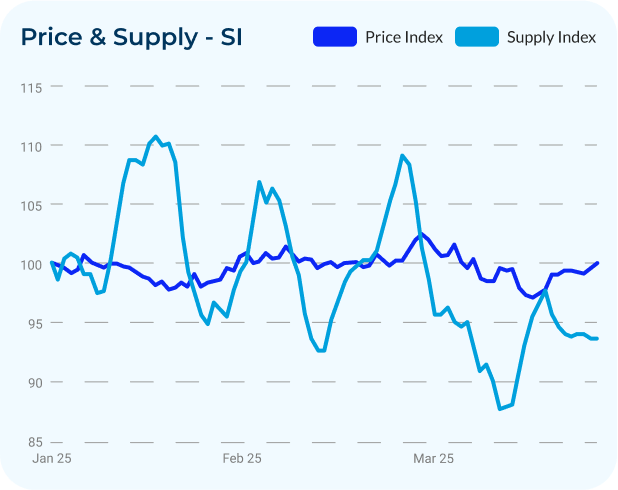

In contrast, SI stones saw prices fall by 5% through January, before stabilizing across February and March. By the end of Q1, prices had declined by 5.8% overall. Supply followed a similar downward trend, falling by 23.2% across the quarter. Despite the steadying of prices later in the quarter, SI stones in this size group continue to show softness amid weaker demand.

Round 0.50ct Stones

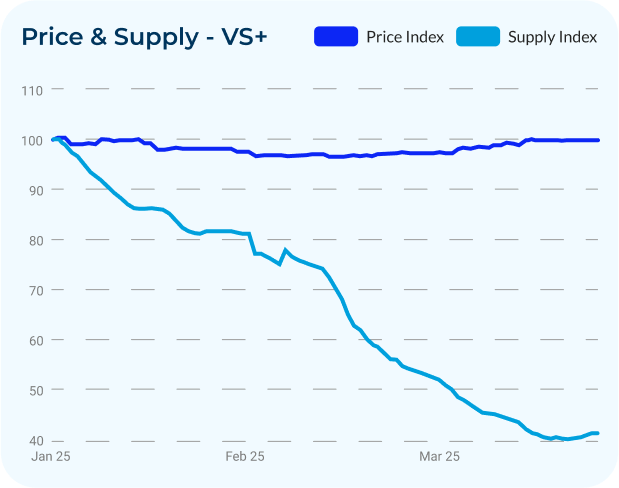

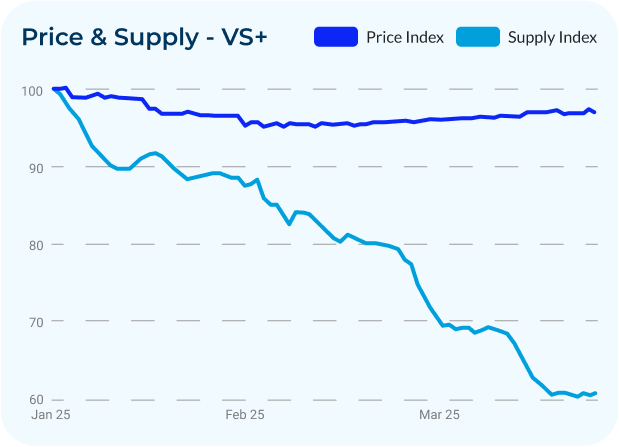

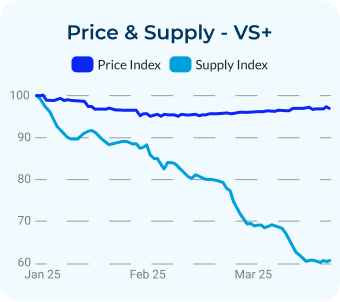

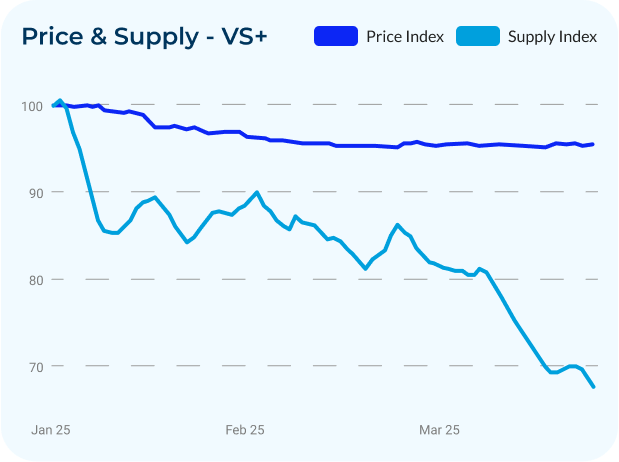

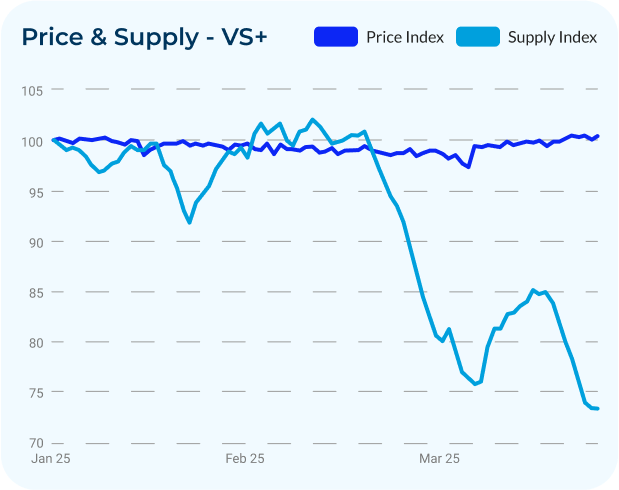

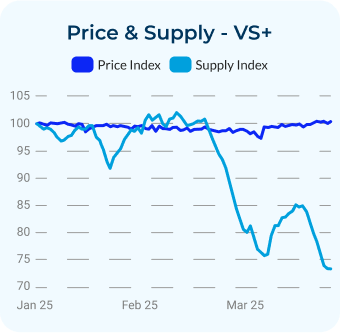

In Q1 2025, 0.50ct Round stones showed clear differences between the VS+ and SI categories. For VS+ stones, prices dropped slightly in January but remained stable through February and March. Overall, prices declined by just under 3% during the quarter. Supply dropped steadily throughout Q1, resulting in a 39% overall reduction. This significant supply contraction helped support price stability, indicating a more balanced market for higher-clarity stones in this size group.

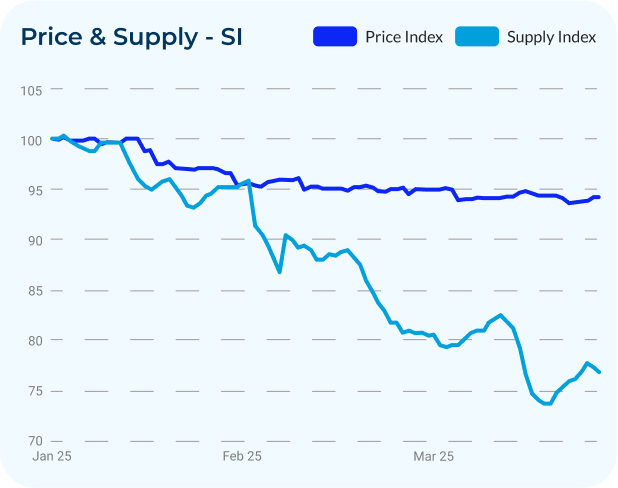

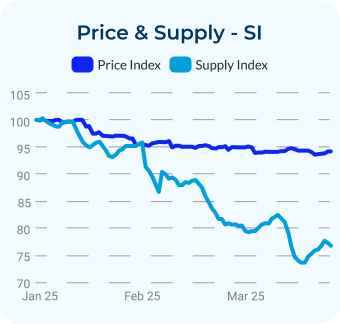

SI stones experienced steeper price decreases, particularly in January, largely driven by broader market pricing pressures and the continued impact of lab-grown replacements in the smaller goods segment. Prices stabilized through February and March, but still registered a 5% decline over the quarter. Supply for SI stones also fell during Q1, dropping by 13% overall. The combination of decreasing prices and reduced supply suggests ongoing efforts to manage inventory levels, though the sharper price drop in SI goods indicates continued price sensitivity in this segment.

Round 1ct Stones

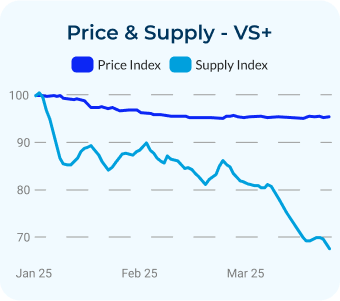

1ct Round stones continued to show differentiated trends across clarity categories over Q1 2025. For VS+ stones, the most significant price drop occurred in January, with prices declining by approximately 4%. February and March brought greater price stability, and by the end of the quarter, the total price drop stood at 4.5%. Within this group, VVS+ D-E-F stones recorded a price increase, while the rest of the size group saw price decreases. Supply for VS+ stones fell consistently throughout the quarter, resulting in an overall 32% reduction, which likely helped temper further price declines as inventory levels tightened.

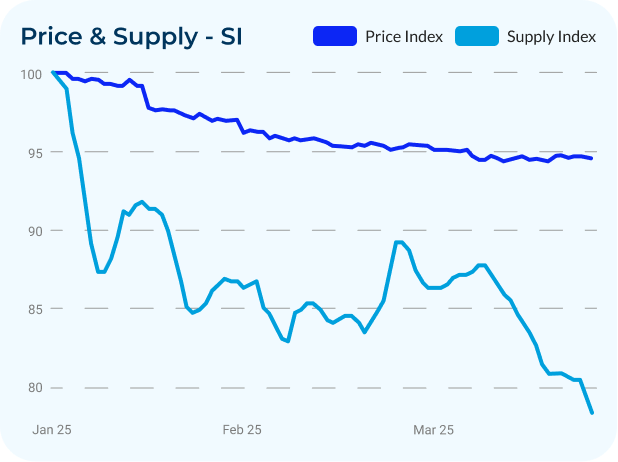

SI stones saw prices fall by 5.5% over the quarter, with the most substantial declines occurring in January. Supply for this category also dropped by 21.6% during Q1. Despite the reduced availability, price pressure persisted throughout the quarter. The market has yet to find the right balance for this segment, which continues to feel the effects of oversupply and weaker demand compared to higher-clarity goods. Until inventory levels and demand are more aligned, price recovery in this category may remain limited.

Round 2ct Stones

2ct Round stones maintained stable price trends across both VS+ & SI categories over Q1 2025. For VS+ stones, prices remained steady throughout the quarter, with only a slight decline of 0.3%. Supply rose briefly in early January but declined consistently from mid-January through the end of March. By quarter’s end, supply was down 29.6%, pointing to a tighter market that likely contributed to price stability.

SI stones followed a similar pattern overall, with overall prices showing a minimal decrease of just 0.6% across the quarter. However, there were notable differences based on color. Collection and near-colorless stones saw modest price increases, while light color stones experienced a price decrease. Supply dropped steadily throughout Q1, ending with a total decline of 34.2%. These trends highlight improving balance in the 2ct segment, with price movement increasingly influenced by clarity and color distinctions.

Round 3ct Stones

3ct Round stones remained stable over Q1 2025. VS+ stones saw a 0.4% price increase, while SI stones ended the quarter at the same price level as they began. The category continues to show strength, particularly among higher-clarity stones, supported by consistent buyer interest.

Key Insights

Stabilization in the Market

Q1 2025 marked a potential turning point for the diamond market, with signs that it may have found a new equilibrium. The Diamond Index dropped by just 1.5%, with most of that movement concentrated in January following price list reductions. February and March saw steadier conditions across most categories, along with early signs of upward price momentum in select segments. Notably, the Fancy Index continued its consistent upward trend, rising by 1.25% over the quarter—highlighting both stable demand and tightening availability in popular shapes. With inventory running low in certain high-demand categories, the overall market appears more balanced and potentially poised for future price increases. However, the recent implementation of U.S. tariffs has introduced a new layer of uncertainty, and the full impact on global pricing, supply, and demand dynamics remains to be seen.

Supply Reductions Supporting Price Stability

Across the board, reduced supply helped restrain price fluctuations throughout Q1 2025. VS+ stones in the 0.30ct, 0.50ct, 1ct, and 2ct categories saw consistent supply declines of 58%, 39%, 32%, and 29.6%, respectively. These reductions played a key role in creating more stable pricing conditions and restoring balance to these segments.

SI Categories Still Show Price Sensitivity

SI stones continued to show softness across Q1 2025, with limited demand and ongoing pricing pressure in most size groups. Prices declined by 5.8% for 0.30ct, 5% for 0.50ct, and 5.5% for 1ct stones, while 3ct stones ended the quarter with no net price change despite significant fluctuations. These trends reflect a segment still struggling to find its footing as the market works to rebalance after a period of oversupply. Until demand for lower-clarity goods strengthens, SI categories are likely to remain under pressure.

3ct Stones Hold Strong

The 3ct category remained resilient in Q1 2025, with prices holding steady across clarity groups. VS+ stones saw a slight price increase, reflecting stable demand in the higher-quality segment. This consistency points to continued buyer interest in 3ct goods, even as other segments face more volatility.

Use UNI Diamonds’ data-driven tools to monitor these evolving patterns, adjust your pricing and inventory strategies, and stay competitive in a market that’s showing signs of renewed balance.

Conclusion

Q1 2025 marked another step toward stability in the diamond market. While January saw price drops sparked by reductions in market price lists, February and March brought steadier conditions across most categories. The Diamond Index fell by just 1.5%, showing a slower pace of decline compared to earlier quarters.

VS+ stones, particularly VVS+ collection color goods, performed well, with prices stabilizing or rising in some areas. Meanwhile, broader VS goods saw more subdued results, and SI stones continued to underperform, with ongoing price softness and weaker demand across most size groups.

In parallel, newly introduced U.S. tariffs may reshape global trade flows, with potential ripple effects on pricing, demand, supply, and the overall availability of goods. While the full impact is still unfolding, these measures have added a layer of uncertainty—particularly for suppliers in major export hubs like India, Israel, and Belgium.

As prices begin to strengthen and inventory tightens in select categories, reliable data becomes more essential than ever. UNI Diamonds equips both buyers and sellers with the tools to navigate market changes in real time—helping you stay informed, manage inventory effectively, and, most importantly, secure goods at cash prices as the market shifts. In a rapidly evolving environment, UNI ensures you're always ready to act with speed and certainty.

Ready to Elevate Your Diamond Trading?

Leave your details to book a demo and one of our representatives will get back to you as soon as possible!