Industry Report Q4 2024

Executive Summary

This report, powered by UNI Diamonds' extensive data and analytics, provides a detailed analysis of the diamond market in Q4 2024, focusing on price trends, supply dynamics, and key size groups. Following a year of persistent price declines, the market showed signs of stabilization in Q4, with the Diamond Index dropping just 1%. This marked a significant slowdown in price reductions, driven by seasonal demand and shifting supply levels.

VS+ stones across all size categories benefited from notable supply reductions, resulting in smaller price drops and steadier conditions. In contrast, SI stones exhibited varied supply trends, with increases in some categories raising concerns about potential oversupply and further price declines.

For larger stones, such as 2ct and 3ct, limited price drops and tightening supply highlighted opportunities for buyers to secure high-quality stones. Meanwhile, strong demand in the 3ct SI category demonstrated resilience in this segment despite increased supply levels.

Discover how UNI Diamonds’ market insights can empower your diamond trading strategies to stay ahead.

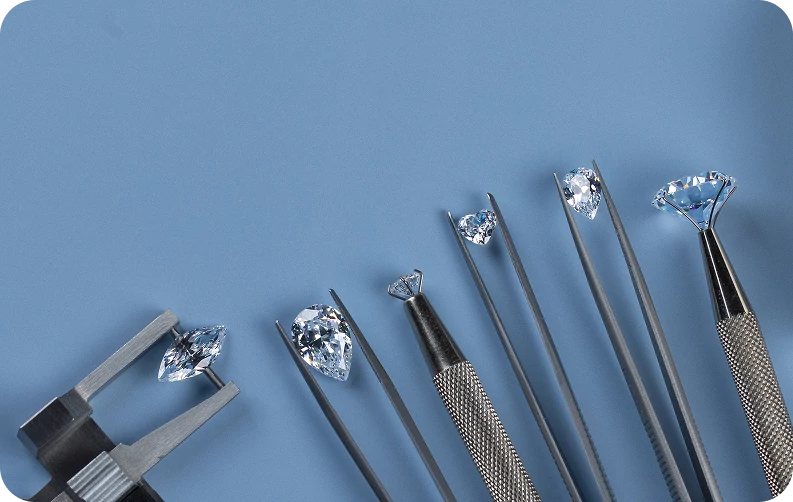

Overview of the Industry

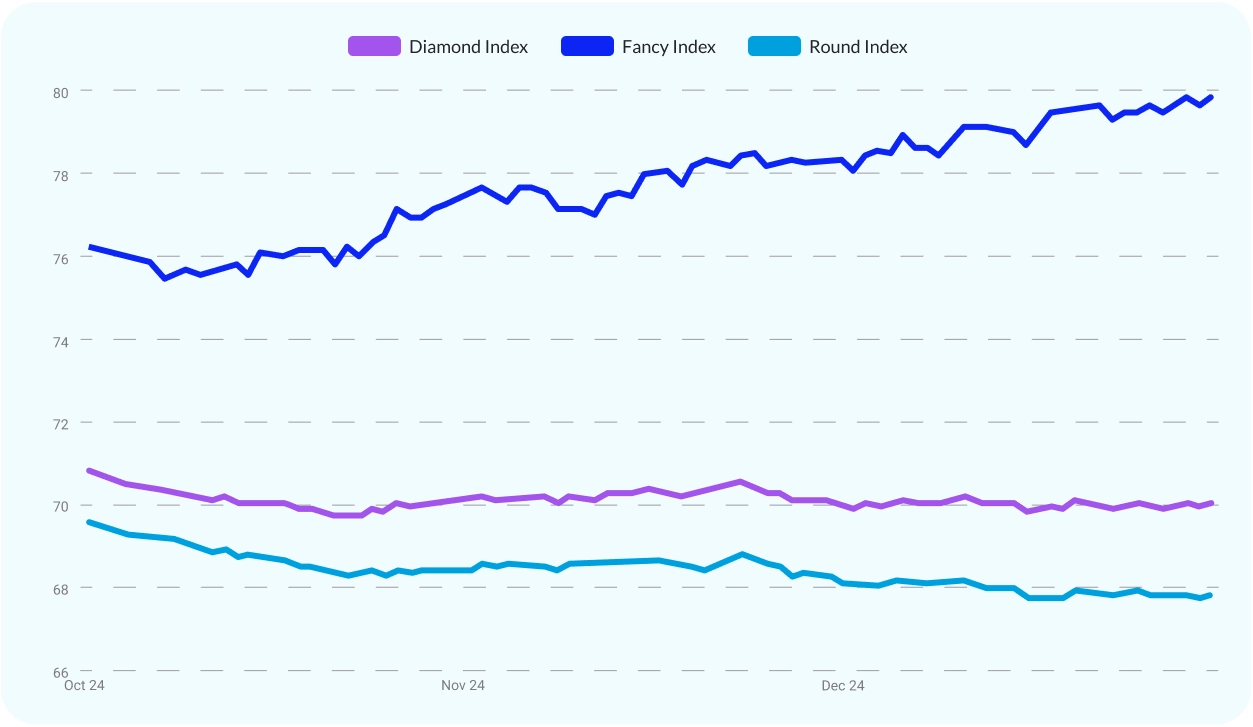

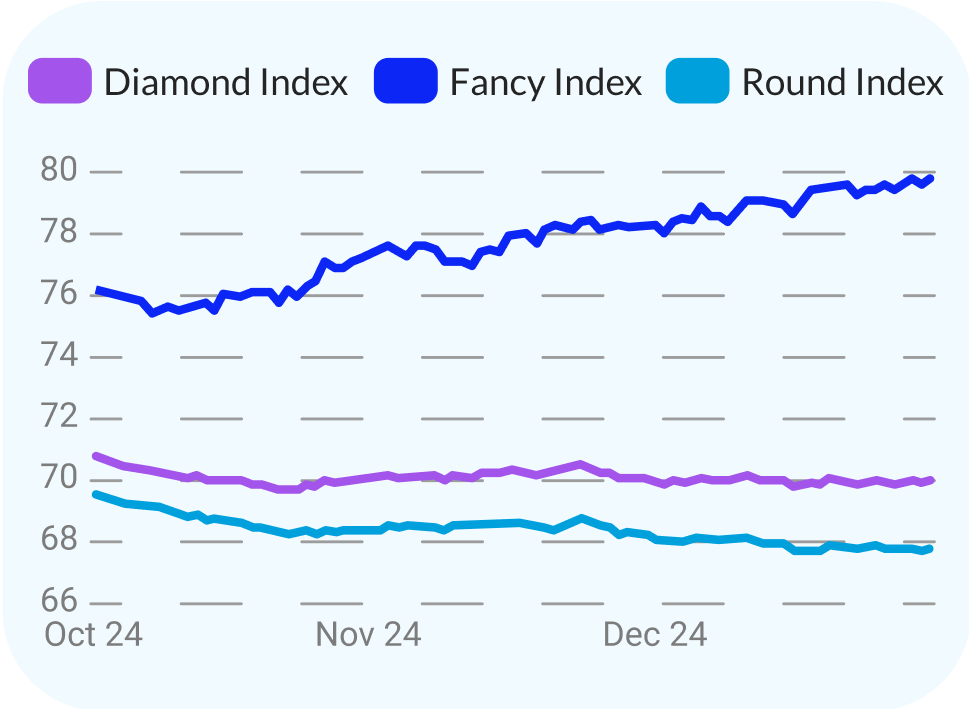

Diamond Index

Throughout Q4 2024, the Diamond Index demonstrated a marked stabilization following persistent declines earlier in the year. The overall index dropped by just 1% during the quarter, signaling a slowdown in price falls. This stabilization aligns with seasonal demand during the holiday period.

The Diamond Index tracks overall price trends in the diamond market. Built from comprehensive analysis of market transactions, it reflects price movements for both Round and Fancy-shaped stones. By monitoring the Diamond Index, you can gain valuable insights into market behavior, anticipate shifts, and make data-driven trading decisions.

Round Index

The Round Index saw a decline of approximately 2% in Q4 2024. This decline is moderate compared to the sharper decreases experienced earlier in the year, indicating a slowing rate of price drops. Seasonal demand during the holiday period may have contributed to this moderation, but the round diamond segment continues to face shifting market dynamics.

Fancy Index

In contrast, the Fancy Index increased by 4% during Q4 2024. This upward trend highlights a growing demand for fancy-shaped diamonds. The Index’s consistent growth throughout the quarter reflects its resilience and position as a key driver of market dynamics.

Leverage UNI Diamonds' powerful analytics to understand market shifts, track pricing trends, and make data-driven decisions for your inventory.

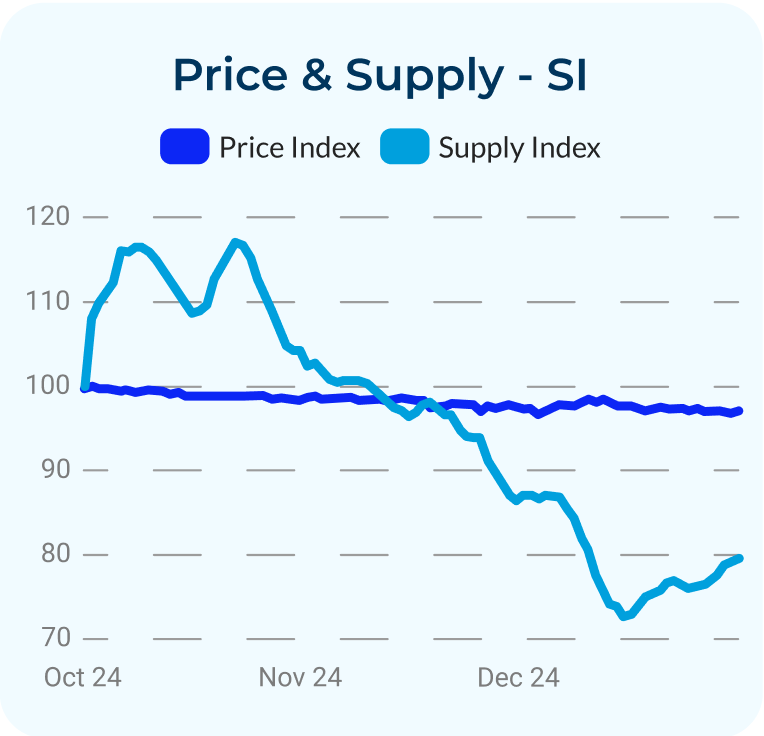

Round 0.50ct Stones

In Q4 2024, 0.50ct Round stones showed different trends between VS+ and SI categories. VS+ stones saw a price drop of 2.5%, which was smaller than in earlier quarters, while supply fell by 18%, pointing to a tighter market and some signs of steadiness. SI stones, on the other hand, had a slightly bigger price drop of 3%, along with a 6% increase in supply. The difference in supply levels between VS+ and SI categories under similar price changes highlights potential oversupply in the SI segment, which could lead to further price decreases if demand does not catch up.

Round 1ct Stones

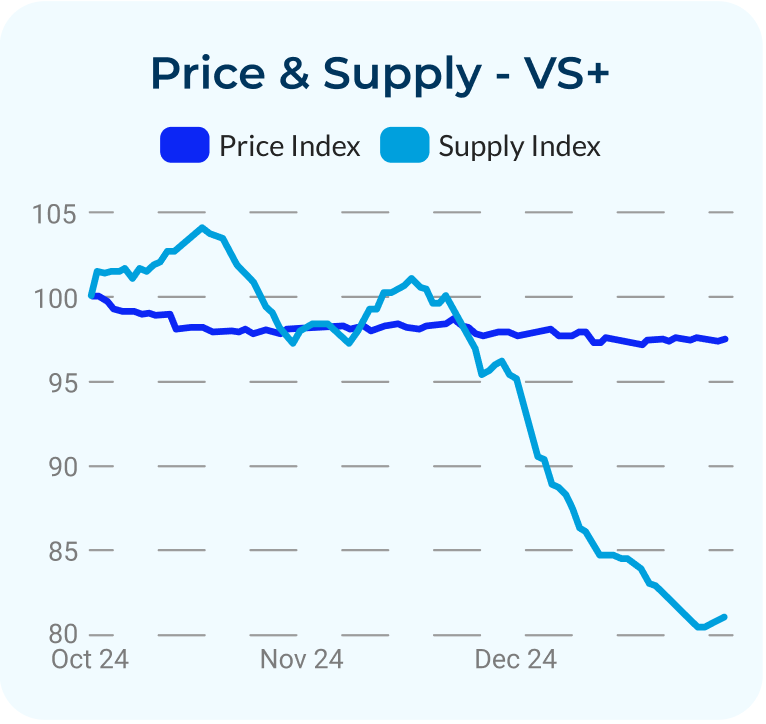

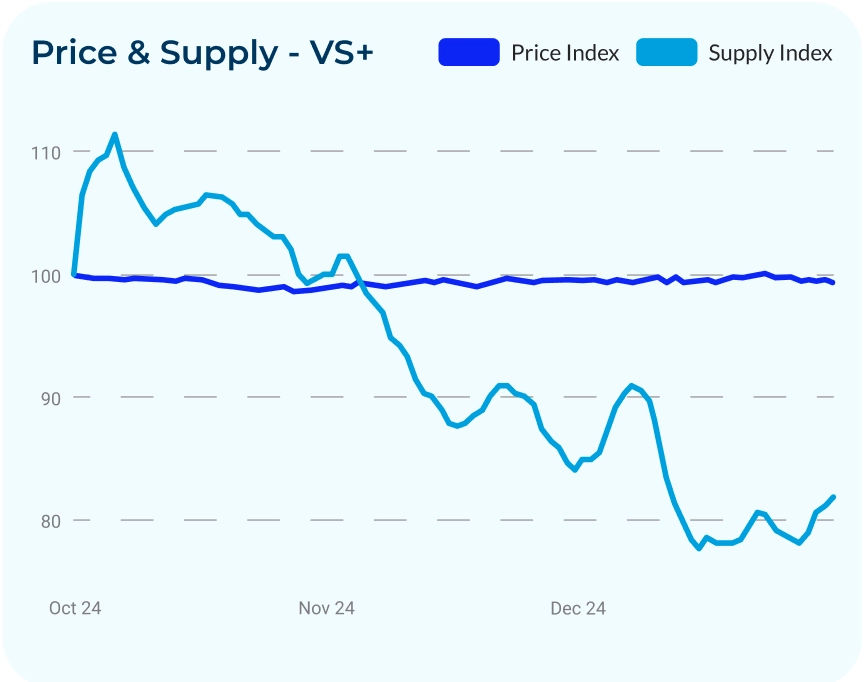

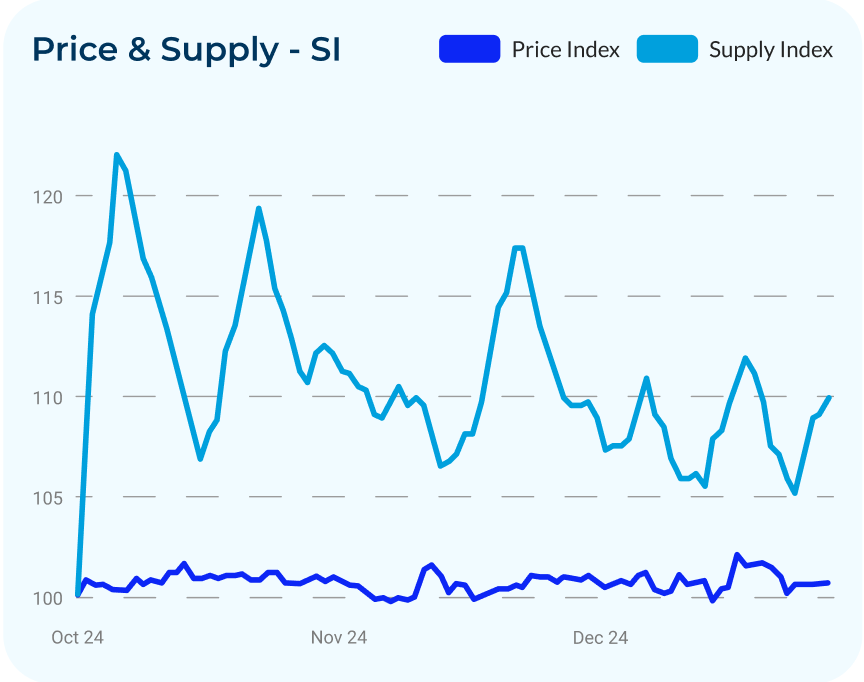

In Q4 2024, prices for 1ct Round stones showed different trends across categories. For VS+ stones, prices dropped by approximately 4%, continuing the downward trend from earlier in the year but at a slower rate. Supply for VS+ stones was more volatile, with a 10% increase in October, followed by an overall supply drop of 24% during the quarter. This decrease in supply likely helped prevent sharper price declines, suggesting some steadiness in this category.

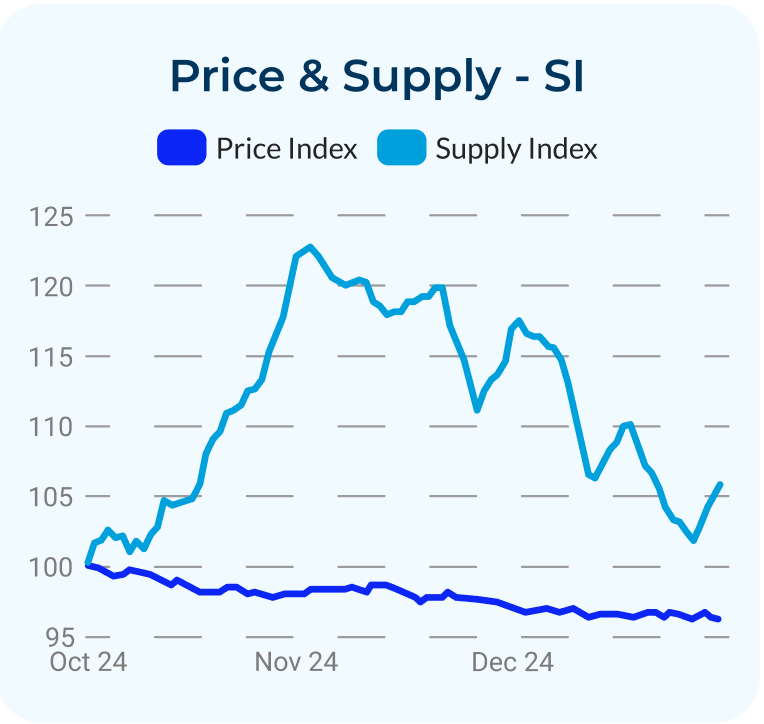

For SI stones, prices fell slightly more, with a drop of just over 5% during Q4. Unlike VS+ stones, SI supply increased sharply by 19% in October but ultimately dropped by 6% overall by the end of the quarter. The difference in supply levels between VS+ and SI categories, combined with the more significant price drop in SI stones, suggests a potential market oversupply in SI goods, which may cause further price decreases if current inventory levels remain high relative to demand.

Round 2ct Stones

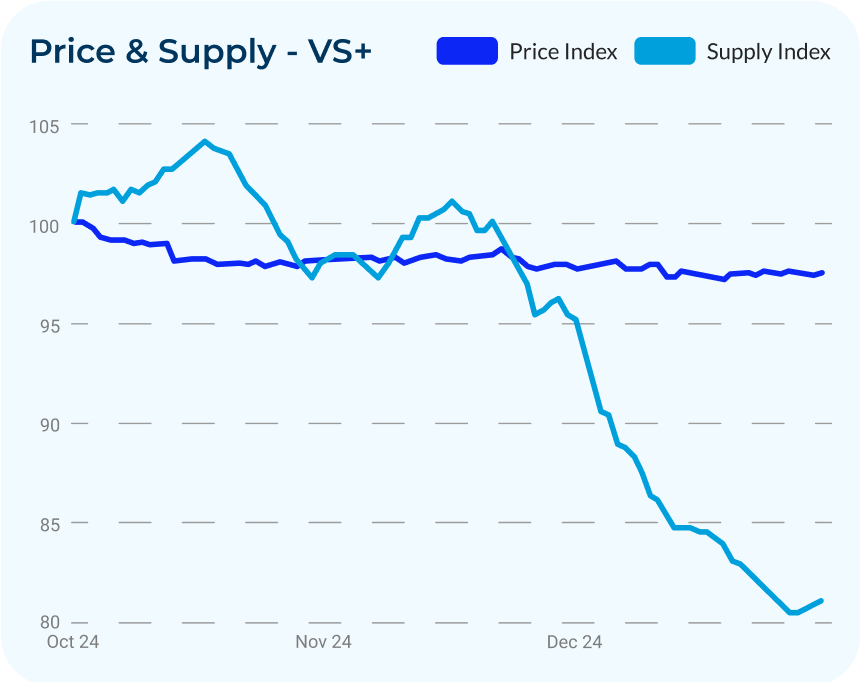

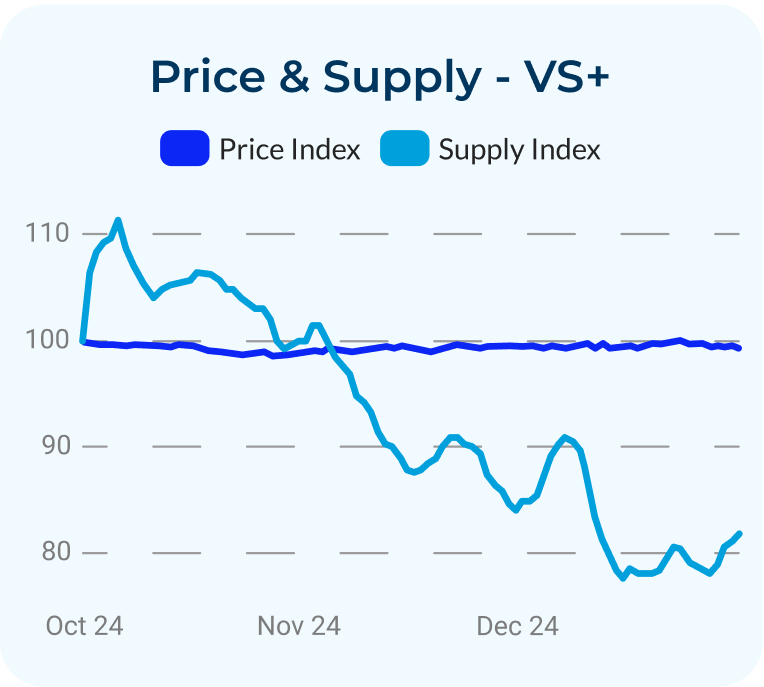

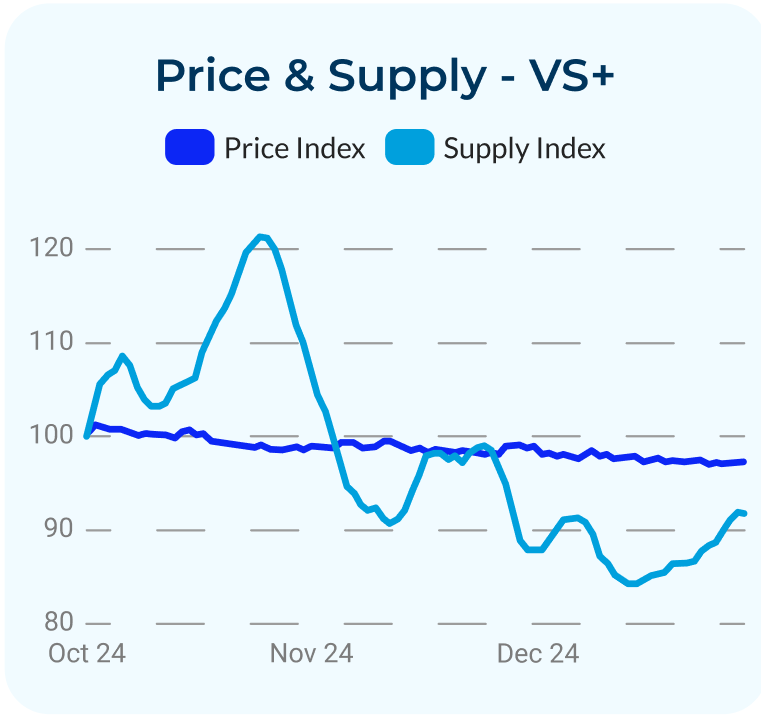

Prices for 2ct Round stones were stable during Q4 2024, with slight differences across categories. VS+ stones saw minimal price movement, dropping by less than 1% over the quarter. Supply was more volatile, with a 13% increase in October followed by an overall drop of 16% by the end of the quarter. This supply reduction likely helped keep prices steady.

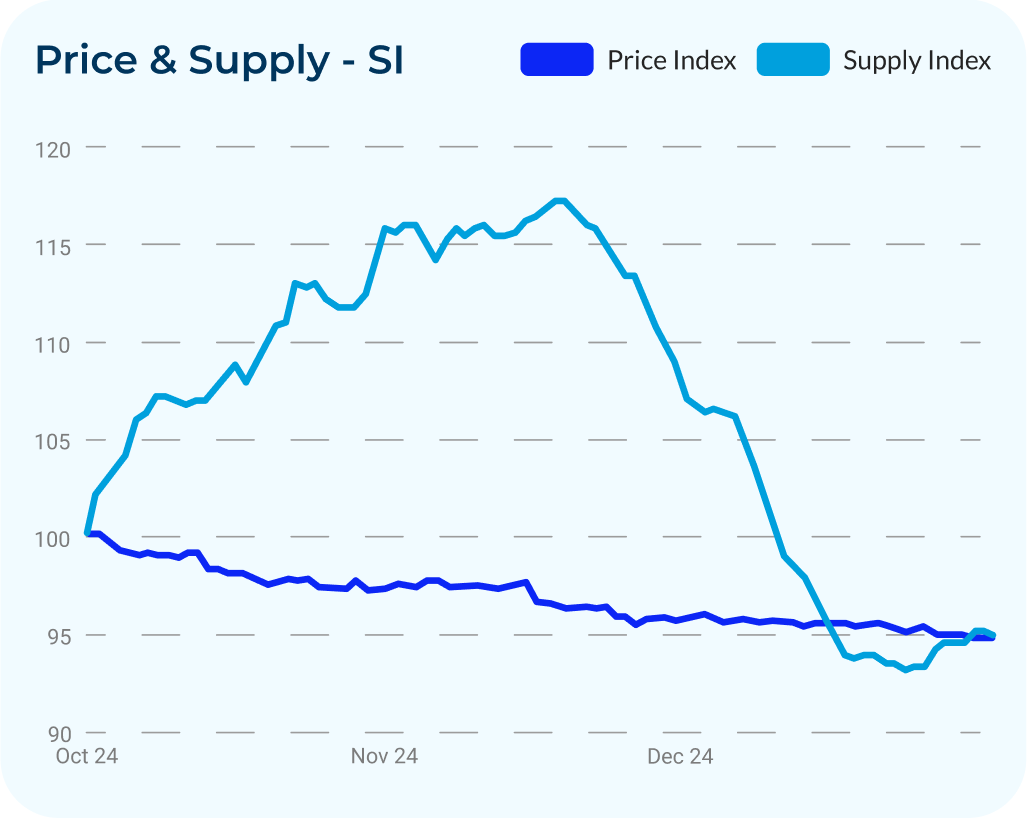

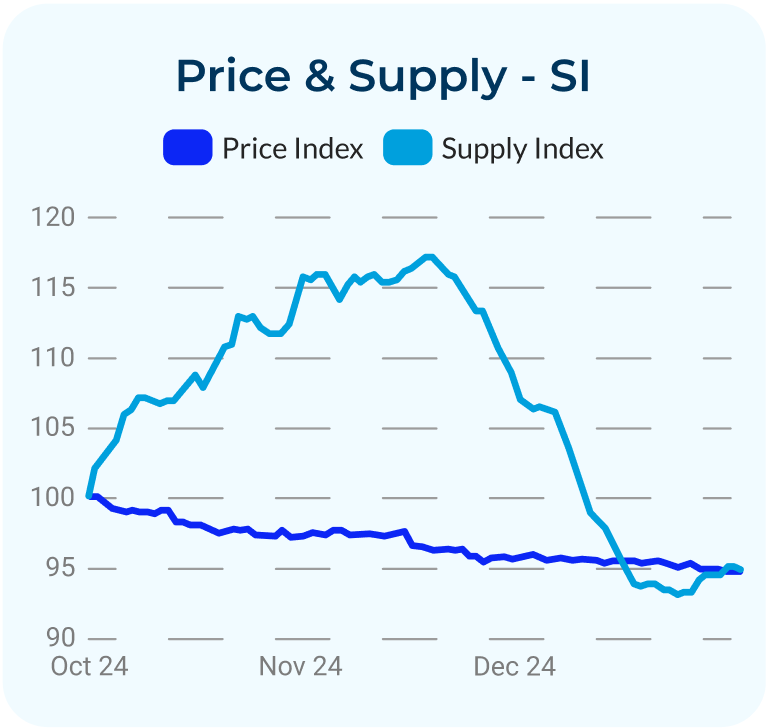

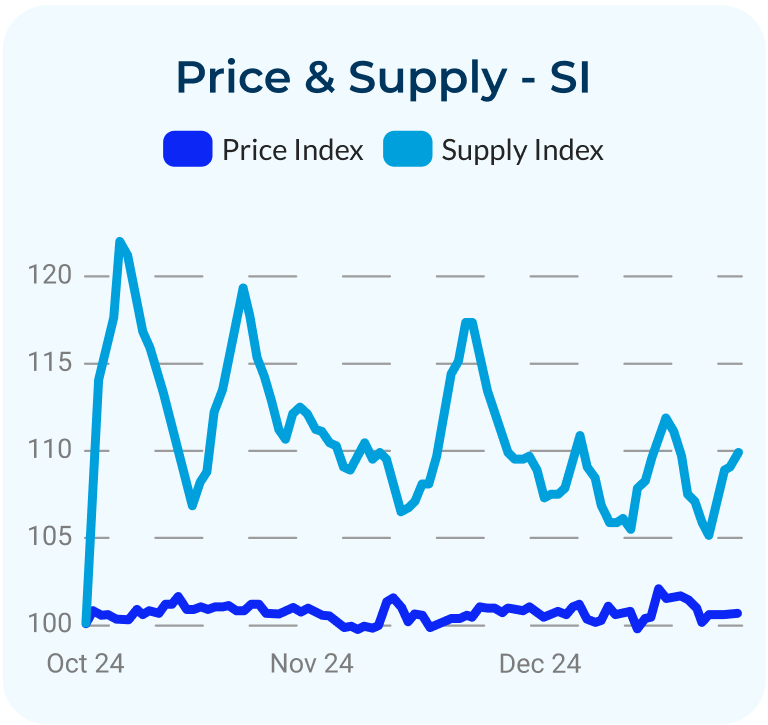

SI stones had a slightly larger price drop of around 3% during Q4. Supply for SI stones followed a similar trend to VS+ stones, rising sharply by 22% in October but steadily decreasing through November and December. By the end of the quarter, SI supply had fallen by 19%, showing the market adjusting to changing demand and inventory pressures.

Round 3ct Stones

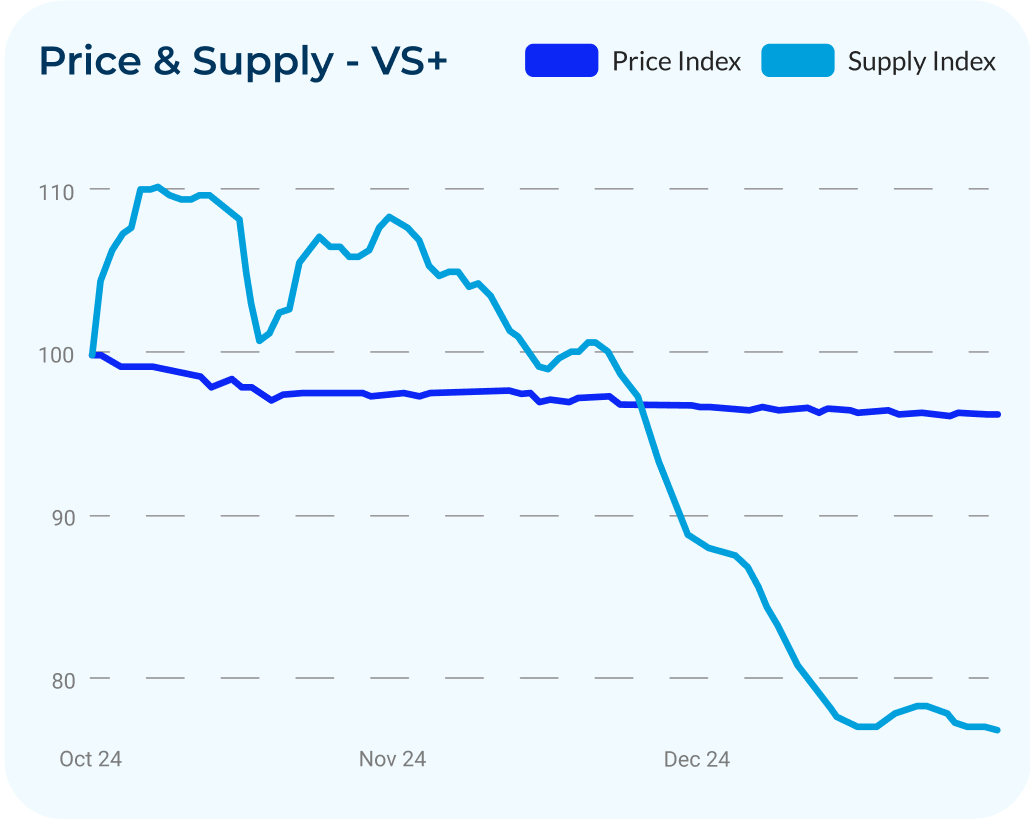

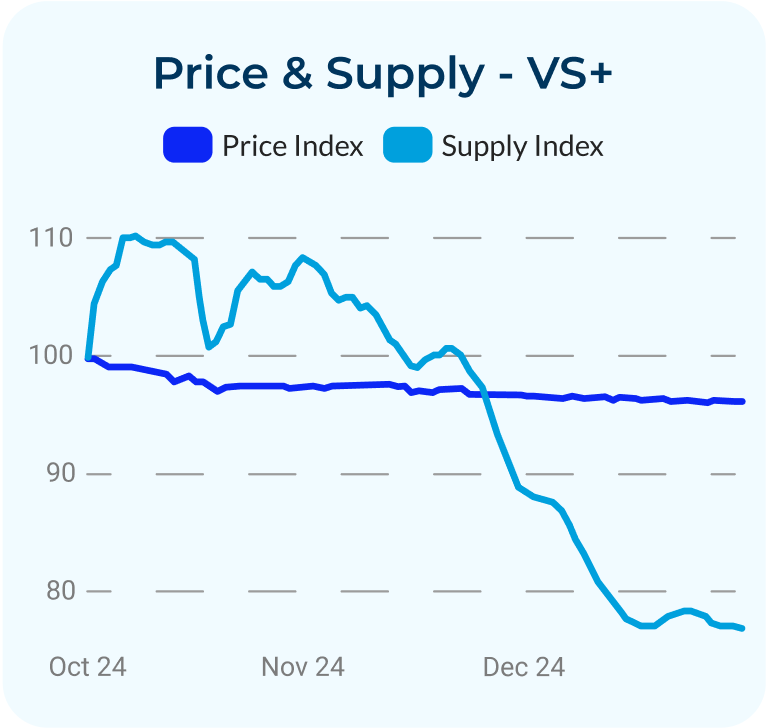

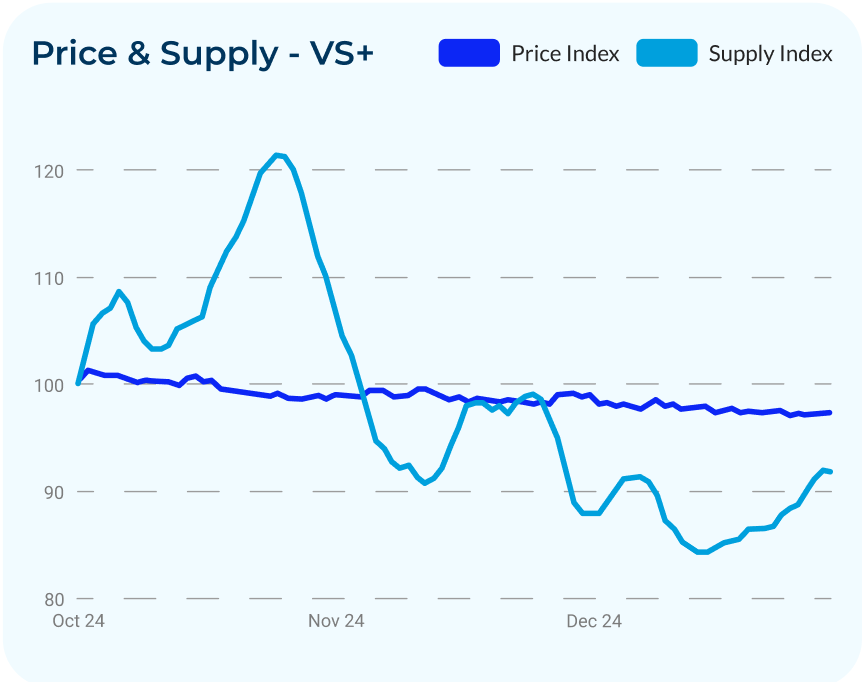

In Q4 2024, the price and supply trends for 3ct stones showed clear differences between VS+ and SI categories. Prices for VS+ stones dropped modestly by around 3% over the quarter. Supply was volatile, rising by 22% in October before declining, resulting in an overall supply drop of 11% by the end of the quarter. This reduction in supply likely helped stabilize prices for VS+ stones.

In contrast, SI stones saw a small price increase of 1% during Q4, with the biggest rise of around 3% occurring in December. Supply for SI stones trended upward throughout the quarter, with a sharp 26% increase in October and an overall supply growth of 8% by the end of Q4. This may suggest steady demand for SI stones, helping to support price stability despite the increase in supply.

Key Insights

Price Sensitivity and Supply Dynamics

One of the main takeaways from Q4 2024 is the stabilization of the overall Diamond Index, which dropped by just 1%. This marks a significant slowdown in price declines compared to earlier quarters, suggesting that the overall market might have reached a more balanced state. However, within this stable market, contrasting dynamics were observed between VS+ and SI goods.

For VS+ stones, the reduced supply across most categories helped limit price drops, indicating that this segment might have found its new balance point. In contrast, the increase in supply for SI goods, particularly in certain carat sizes, signals the potential for further price decreases if demand does not catch up with inventory levels.

0.50ct and 1ct Categories

For smaller stones, such as 0.50ct and 1ct, the significant reduction in VS+ supply (18% for 0.50ct and 24% for 1ct) shows a clear adjustment to market conditions. These reductions have helped stabilize prices, suggesting that these categories are becoming steadier. In contrast, the supply increases in SI goods, particularly early in the quarter, highlight a risk of oversupply. Without sufficient demand to absorb this inventory, prices in the SI category may continue to decline.

Larger Carat Stones (2ct and Above)

In larger carat sizes, limited price drops for VS+ stones (< 1% for 2ct and 3% for 3ct), combined with notable supply reductions (16% and 11%, respectively), indicate a tightening market. These trends create opportunities for buyers to secure high-quality stones before potential price increases as supply continues to decrease. For SI goods, the ability of the market to absorb additional supply in the 3ct category, where prices rose by 1%, reflects strong demand in this segment. This resilience suggests opportunities for sellers in larger carat weights, where demand remains robust despite rising inventory levels.

Use UNI Diamonds' real-time data and advanced tools to act on these trends now—optimize your inventory, capitalize on opportunities, and stay ahead in the competitive diamond market.

Conclusion

Q4 2024 was marked by overall market stabilization, with the Diamond Index dropping just 1%, signaling a slowdown in price declines. VS+ stones saw smaller price drops due to significant supply reductions, reflecting steadier market conditions. In contrast, SI goods experienced increased supply in some categories, raising the risk of further price decreases if demand doesn’t catch up.

Smaller stones like 0.50ct and 1ct showed tighter supply for VS+ goods, helping stabilize prices, while SI goods faced oversupply challenges. Larger stones (2ct and 3ct) demonstrated strong demand in the SI category and tightened supply for VS+, creating opportunities in higher-quality segments.

Despite our data over Q4 showing overall stabilization and only small decreases in some categories, the January price list reductions in the market have fueled the continued price declines we are now seeing.

Unlock real-time data, track market changes, and refine your strategies for sourcing or selling. Whether you're a buyer or a seller, leverage UNI to secure opportunities, optimize inventory, and stay ahead in the diamond industry.

Ready to Elevate Your Diamond Trading?

Leave your details to book a demo and one of our representatives will get back to you as soon as possible!